Registration Under GST

When registration required under GST?

}

Every

supplier shall be liable to be registered under this Act in the State or Union

territory, other than special category States*, from where he makes a taxable

supply of goods or services or both, if his aggregate turnover* in a financial year exceeds 40 lakh

rupees for Goods and 20 lakh for Services

*special category states limit is 20 lakh for goods and 10 lakh for services

}

A

person who has obtained or is required to obtain more than one registration,

whether in one State or Union territory or more than one State or Union

territory shall, in respect of each such registration, be treated as distinct

persons for the purposes of this Act.

}

Where

a person who has obtained or is required to obtain registration in a State or

Union territory in respect of an establishment, has an establishment in another

State or Union territory, then such establishments shall be treated as

establishments of distinct persons for the purposes of this Act.

}

If

having place of business in same state than can add it as additional place of

business.

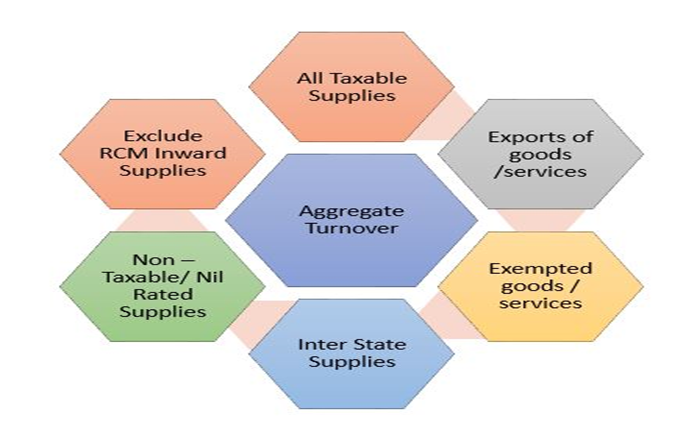

*aggregate

turnover” means

the aggregate value of all taxable supplies (excluding the value of inward

supplies on which tax is payable by a person on reverse charge basis), exempt

supplies, exports of goods or services or both and inter-State supplies of

persons having the same Permanent Account Number, to be computed on all India

basis but excludes central tax, State tax, Union territory tax, integrated tax

and cess;

In India, an indirect tax known as the Goods and Services Tax (GST) is imposed on the provision of goods and services. Each and every taxpayer who has registered for GST is required to submit GST tax returns. The government uses these returns to determine its tax obligation.

ReplyDeleteAll people and organisations selling goods or services in India are required to register for GST. When the total value of supplies reaches Rs. 20 lakh, GST registration is required. To make the process of submitting taxes simpler, the Ministry of Finance (MoF) simplified the GST Registration Process. If the value exceeds Rs. 10 lakh per year and the firm operates in a special category state, GST registration is required. Let's examine the requirements for acquiring GST registration in this post. The post also discusses the paperwork needed and the online GST registration process.

ReplyDeleteI like your suggestions they are really helpful. Thank you so much for sharing this post. gst registration in Mumbai

ReplyDelete